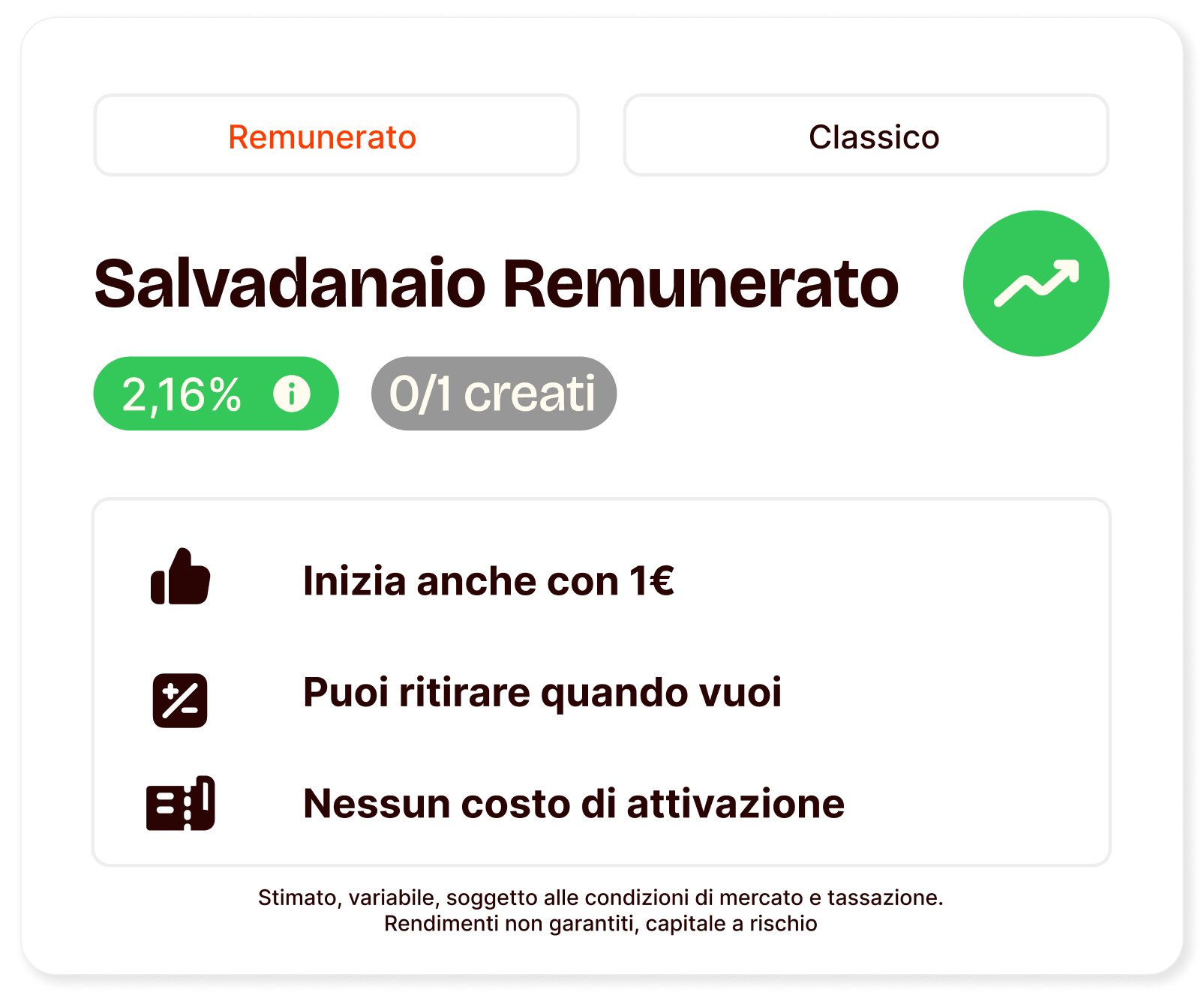

✓ Invest with no minimum amount

✓ Withdraw your money whenever you want, with no constraints

✓ Zero hassle, plenty of advantages

Variable return subject to market conditions and taxation. As with all investments, capital is not guaranteed.*

Download the app and

get 25€

with the promocode: INVEST25

We manage the taxes for you. No activation fees and zero withdrawal costs. Enjoy a truly seamless experience.

Your money is available within one business day, with no withdrawal limits or time constraints. No minimum investment required.

Ultra-low risk profile. A concrete opportunity for those seeking stability without sacrificing favorable returns.

It's so simple, it almost doesn't need explaining.

Go to your Profile, find the Save and invest section, and open your first Invested Money Box.

Add the amount you prefer, directly from your Satispay available balance or from your current account. Remember: there is no minimum amount required.

Automate your investments: set up a recurring transfer or round up your purchases using our Change feature. Then, simply forget about it!

You have everything under control: you can always track the performance of your investments directly from the app.

With the Invested Money Box, you invest in a money market fund with a currently estimated annualized return of 1.89%¹, and your investments are updated daily.

If you wish, you can set up recurring deposits for your savings. Choose the amount and frequency: daily, weekly, or monthly. Simple and practical!

Check your investment results, both since you started and for the last month. This way, you always have everything under control.

View all deposits made over time and follow the journey of your investments. A look at the past helps you plan the future even better.

It is a new savings feature within the Satispay app² that allows you to invest your savings in a money market fund, managed by Amundi Asset Management.

Generally, a money market fund pools capital to invest in low-risk, highly liquid, and short-term financial assets. These include short-term government securities, bank deposits, and bonds issued by companies with high credit ratings.

Simple and intuitive, perfect even if you have no investment experience!

There is no minimum amount required. No activation cost, no limits, no restrictions—just maximum flexibility!

With the Invested Money Box, you invest in a money market fund with a low risk profile, designed for long-term stability. This means the potential loss on your investment is a very low risk, even if capital market conditions are poor. Furthermore, the assets the fund invests in (such as government securities or bonds) are held by a third party (the fund's depositary bank) and always remain separate from the assets of the fund manager and Satispay. Therefore, even in the remote event that the fund manager or Satispay were to face solvency issues, the assets in which the fund invests would be protected from the creditors of the fund manager or Satispay.

Absolutely yes. You can deposit or withdraw your money whenever you want, with no constraints. The withdrawn amount will be available in your Satispay balance by the next business day. The Invested Money Box is designed for short-term investments, and the recommended holding period is at least 1 month.

We handle everything! Taxes are automatically calculated and withheld from the return generated by your investment, so you don’t have to worry about anything. Taxes will be calculated and paid automatically when you decide to withdraw your money from the Invested Money Box. The estimated annualized return you see in the application is net of applied fees and gross of taxes. Remember that taxation depends on your personal situation and may change in the future.

No fixed costs whenever you invest or withdraw your savings! The estimated annualized return is net of fees, which are 0.17% for management fees and an estimated 0.03% related to fund transaction costs. Satispay fees are 0.24%. For more information, consult the page dedicated to costs.

Compound interest is an interest calculation mechanism in which the interest accrued on an initial principal is reinvested, in turn becoming part of the capital on which new interest is calculated. In other words, you earn interest not only on the initial principal but also on the interest accumulated in previous periods. Regarding your investment, the money market fund does not distribute its proceeds (interest or returns) to investors but automatically reinvests them into the fund. This continuous reinvestment of returns creates a compound interest mechanism, because the earnings remain within the fund and, in turn, generate new earnings, promoting a progressive growth of the invested capital over time.

Currently, the estimated annualized return can reach up to $2.18¹. This return is net of Satispay and fund fees (but taxes must still be applied). The fund's performance is linked to the reference interest rates set by the European Central Bank. This means that any increases in interest rates would lead to an increase in the annualized return, while any decreases would lead to a drop in the annualized return. Your investment benefits from the compound interest mechanism, making it worthwhile to leave your money invested over time.

Stamp duty is a tax required by Italian law that applies to financial products, including the Invested Money Box. It is currently 0.20% annually and is calculated on the value of your investment. The exact amount you pay depends on how long you keep the investment active during the year, thanks to a proportional (pro-rata) calculation performed at the end of every calendar year. The good news is that you don't have to worry about calculations or payments: we handle everything! The amount due is automatically debited from your Satispay Available Balance once a year, by the end of December. Just make sure you have sufficient funds in your Available Balance during tha

This is a promotional communication. With the Invested Money Box, you can invest in a money market fund which presents a very low risk. Investing involves fluctuations in value, and you could get back less than you invested. The return is variable and is influenced by market conditions, including interest rate and credit risks. The annualized return is an estimate that refers to the weighted average yield of the securities in which the money market fund invests, net of fund costs. The scenarios presented are an estimate of future returns based on evidence related to past changes in the value of this investment and/or based on current market conditions and are not an exact indicator. The repayment amounts will vary depending on market performance and the period of time for which the investment is maintained. Returns are subject to taxation, which depends on the personal situation of each investor and may change in the future. Consult the fund documentation before investing.

This is a promotional communication. With the Invested Money Box, you can invest in a money market fund which presents a very low risk. Investing involves fluctuations in value, and you could get back less than you invested. The return is variable and is influenced by market conditions, including interest rate and credit risks. The annualized return is an estimate that refers to the weighted average yield of the securities in which the money market fund invests, net of fund costs. The scenarios presented are an estimate of future returns based on evidence related to past changes in the value of this investment and/or based on current market conditions and are not an exact indicator. The repayment amounts will vary depending on market performance and the period of time for which the investment is maintained. Returns are subject to taxation, which depends on the personal situation of each investor and may change in the future. Consult the fund documentation before investing.

This is a promotional communication. With the Invested Money Box, you can invest in a money market fund which presents a very low risk. However, capital is not guaranteed and is subject to the risk of loss. The return is variable and is influenced by market conditions, including interest rate and credit risks. The annualized return is an estimate that refers to the weighted average yield of the securities in which the money market fund invests, net of fund costs. The scenarios presented are an estimate of future returns based on evidence related to past changes in the value of this investment and/or based on current market conditions and are not an exact indicator. Repayment amounts will vary depending on market performance and the period of time for which the investment is maintained. Returns are subject to taxation, which depends on the personal situation of each investor and may change in the future. Consult the fund documentation before investing.

Do you still have questions about how the Invested Money Box works? We've created a section compiling some of the most frequent questions we receive on the topic.

Do you still have questions about how the Invested Money Box works? We've created a section compiling some of the most frequent questions we receive on the topic.

Stimato al 03/11/2025, al netto del costo puntuale del fondo a tale data. Tale dato è puramente indicativo, non costituisce una garanzia di rendimento futuro atteso e non rappresenta un rendimento minimo garantito. Tale dato è Stimato al 07/01/2026, al netto del costo puntuale del fondo a tale data. Tale dato è puramente indicativo, non costituisce una garanzia di rendimento futuro atteso e non rappresenta un rendimento minimo garantito. Tale dato è calcolato sulla base delle condizioni di mercato vigenti al momento del calcolo, viene ricalcolato sulla base delle aggiornate condizioni di mercato e considera un orizzonte temporale di breve e brevissimo termine. Il citato dato è annualizzato ed è il Tasso di Rendimento Effettivo a Scadenza – TRES (ovvero, in inglese, lo Yield To Maturity - YTM) medio ponderato dei titoli in cui investe il fondo monetario al netto dei costi del fondo. Il TRES presuppone che vengano soddisfatte alcune condizioni: 1) Mantenimento dei titoli fino alla loro scadenza ovvero, nel caso di titoli a tasso variabile, fino alla successiva revisione del loro tasso variabile; 2) Reinvestimento al tasso TRES di eventuali flussi generati dai titoli; Pagamento puntuale dei flussi generati dai titoli (rimborso parziale/totale del capitale, cedole, ecc..). Si procede all’annualizzazione del rendimento in quanto questo è calcolato su un portafoglio di titoli con una Scadenza Media Ponderata (in inglese Weighted Average Maturity) estremamente breve. Per approfondimenti clicca qui. Consulta il prospetto e il KID del fondo prima di prendere una decisione sull’investimento.

I servizi di investimento sono forniti da Satispay Invest S.A. Questa è una comunicazione di marketing e non costituisce un consiglio di investimento.

Stimato al 03/11/2025, al netto del costo puntuale del fondo a tale data. Tale dato è puramente indicativo, non costituisce una garanzia di rendimento futuro atteso e non rappresenta un rendimento minimo garantito. Tale dato è Stimato al 07/01/2026, al netto del costo puntuale del fondo a tale data. Tale dato è puramente indicativo, non costituisce una garanzia di rendimento futuro atteso e non rappresenta un rendimento minimo garantito. Tale dato è calcolato sulla base delle condizioni di mercato vigenti al momento del calcolo, viene ricalcolato sulla base delle aggiornate condizioni di mercato e considera un orizzonte temporale di breve e brevissimo termine. Il citato dato è annualizzato ed è il Tasso di Rendimento Effettivo a Scadenza – TRES (ovvero, in inglese, lo Yield To Maturity - YTM) medio ponderato dei titoli in cui investe il fondo monetario al netto dei costi del fondo. Il TRES presuppone che vengano soddisfatte alcune condizioni: 1) Mantenimento dei titoli fino alla loro scadenza ovvero, nel caso di titoli a tasso variabile, fino alla successiva revisione del loro tasso variabile; 2) Reinvestimento al tasso TRES di eventuali flussi generati dai titoli; Pagamento puntuale dei flussi generati dai titoli (rimborso parziale/totale del capitale, cedole, ecc..). Si procede all’annualizzazione del rendimento in quanto questo è calcolato su un portafoglio di titoli con una Scadenza Media Ponderata (in inglese Weighted Average Maturity) estremamente breve. Per approfondimenti clicca qui. Consulta il prospetto e il KID del fondo prima di prendere una decisione sull’investimento.

I servizi di investimento sono forniti da Satispay Invest S.A. Questa è una comunicazione di marketing e non costituisce un consiglio di investimento.

Stimato al 03/11/2025, al netto del costo puntuale del fondo a tale data. Tale dato è puramente indicativo, non costituisce una garanzia di rendimento futuro atteso e non rappresenta un rendimento minimo garantito. Tale dato è calcolato sulla base delle condizioni di mercato vigenti al momento del calcolo, viene ricalcolato sulla base delle aggiornate condizioni di mercato e considera un orizzonte temporale di breve e brevissimo termine. Il citato dato è annualizzato ed è il Tasso di Rendimento Effettivo a Scadenza – TRES (ovvero, in inglese, lo Yield To Maturity - YTM) medio ponderato dei titoli in cui investe il fondo monetario al netto dei costi del fondo. Il TRES presuppone che vengano soddisfatte alcune condizioni: 1) Mantenimento dei titoli fino alla loro scadenza ovvero, nel caso di titoli a tasso variabile, fino alla successiva revisione del loro tasso variabile; 2) Reinvestimento al tasso TRES di eventuali flussi generati dai titoli; Pagamento puntuale dei flussi generati dai titoli (rimborso parziale/totale del capitale, cedole, ecc..). Si procede all’annualizzazione del rendimento in quanto questo è calcolato su un portafoglio di titoli con una Scadenza Media Ponderata (in inglese Weighted Average Maturity) estremamente breve. Per approfondimenti clicca qui. Consulta il prospetto e il KID del fondo prima di prendere una decisione sull’investimento.

I servizi di investimento sono forniti da Satispay Invest S.A. Questa è una comunicazione di marketing e non costituisce un consiglio di investimento.

Do you need help?

We are at your disposal for any additional information. Contact us.

Are you a business?

Should you have any questions regarding our service for accepting payments please email us at business@satispay.com

Mobile lost or stolen?

-> Click here!

We are at your disposal for any additional information. Contact us.

Should you have any questions regarding our service for accepting payments please email us at business@satispay.com

-> Click here!

Payment services are provided by Satispay Europe S.A., registered under no. W00000010 in the Register of Electronic Money Institutions at the Commission de Surveillance du Secteur Financier and under no. B229149 in the Luxembourg Business Register. Registered office: 53, Boulevard Royal, L-2449 Luxembourg.

Corporate welfare services are provided by SatisWelfare S.p.A., tax code and registration number in the Milan Business Register no. 12408640964. Registered office: Piazza Fidia 1, 20159 Milan.

Investment services are provided by Satispay Invest S.A. registered under No. P00000555 in the Register of Investment Firms at the Commission de Surveillance du Secteur Financier and under no. B285448 in the Luxembourg Business Register. Registered office: 53, Boulevard Royal, L-2449 Luxembourg.