With Satispay, you have access to the largest corporate welfare acceptance network in Italy. Meal Vouchers, Satispay Benefits, FlexBen: we have everything you need to simplify corporate benefit management. Welfare becomes easy and digital.

*Maximum spendability: *from meal vouchers to Satispay benefits, up to reimbursements for training, travel, health, and sports expenses. And if you want, convert welfare credit into gift cards in a few clicks.

100% deductible and spendable even at dinner and on weekends, with payments in a single transaction.

Total deductibility and ease of use, they are a concrete support to the salary thanks to the network of over 400,000 affiliated locations.

Tax savings for company and employee*. 100% digital and intuitive, without complicated platforms.

Have you ever thought that making your employees happy could save you money? With Satispay Welfare products, it’s exactly like that!

For employees:

1. More purchasing power: tax-free benefits within legal limits.

2. Maximum flexibility: autonomous choice of benefit usage.

3. Wide spendability: welfare network widespread throughout Italy.

For companies:

1. Tax advantages: deduction of costs and reduction of tax burden.

2. Loyalty: more well-being and trust from employees.

3. Employer branding: attraction and retention of top talent.

Satispay FlexBen is one of the many things you can have with Satispay. But there is much more. Here is everything you can do with the app:

Pay from your smartphone in two moves in Satispay affiliated stores. All without cards and cash.

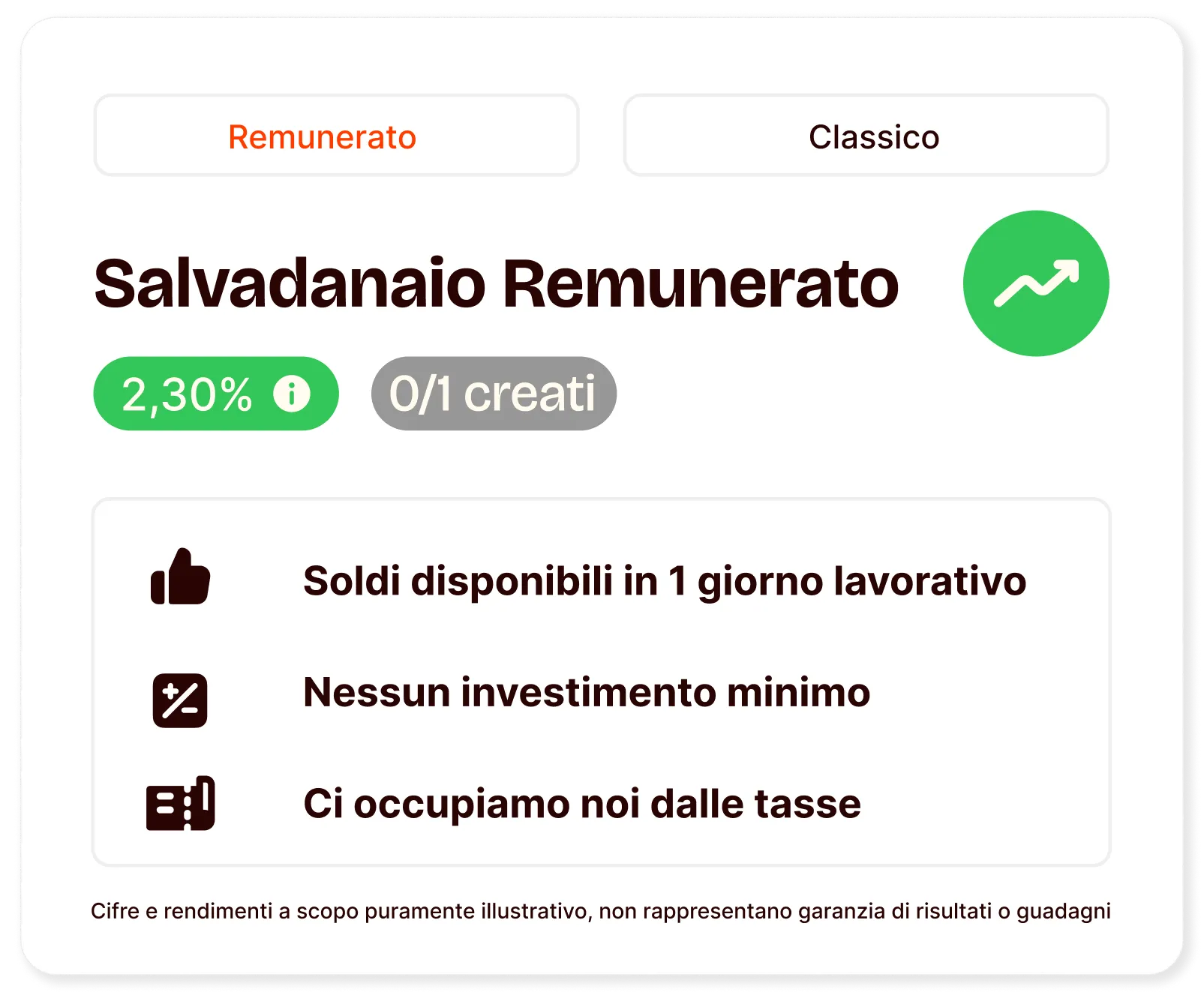

✓ Invest simply and without a minimum amount

✓ Withdraw your money whenever you want, without constraints

✓ Zero worries, lots of advantages

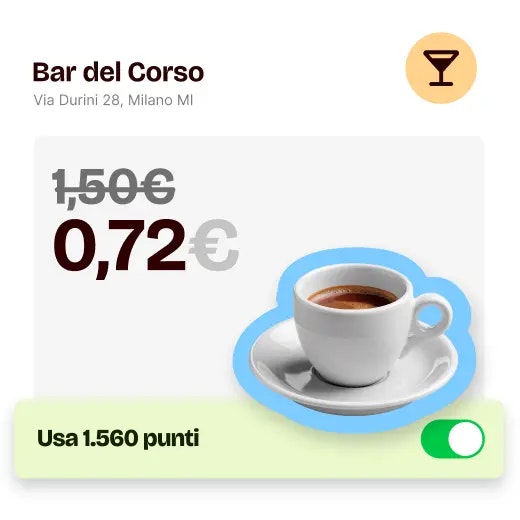

Earn Points and get discounts on your purchases in 400,000 physical and online shops and in in-app services. It's easy, fast, free.

Create a personalized Piggy Bank, set a savings goal, and choose 3 ways to start accumulating (and multiplying!) money.

Split a dinner bill with friends or reimburse money advanced for a group gift. Give more space to people than to transactions.

We root for ambitious challenges and pooled collections. With the app, you can collect money in a flash and say goodbye to rounds of phone calls and messages.

Choose Satispay as a payment method at checkout and pay in thousands of shops simply and securely, directly from the app.

Your entry into Satispay deserves much more than a thank you. Enter with a €5 Welcome Bonus¹.

Corporate welfare includes the set of benefits and services that a company offers to its employees to improve their well-being and quality of working life. It is important because it contributes to increasing worker satisfaction, promotes loyalty, and can improve the overall productivity of the company.

The main advantages for employees include an increase in the remuneration package and purchasing power, thanks to tax-free benefits within the thresholds established by regulations. Furthermore, it offers flexibility, allowing employees to choose how to use benefits based on their personal needs.

Satispay offers a digital solution for corporate welfare management, providing tools like Meal Vouchers and Satispay Benefits. Companies can distribute these benefits to employees, who use them via the Satispay app at a vast network of affiliated merchants.

Yes, Satispay Welfare is designed to adapt to the needs of companies of any size, offering flexible and scalable solutions for both small businesses and large organizations.

To receive Satispay Benefits, the employer provides an activation code. Employees must download the Satispay app, register, and enter the code in the "Connect app with Welfare" section to activate the vouchers. Once activated, they can be used like a normal payment with Satispay at affiliated merchants.

Satispay Benefits can be spent in over 170,000 affiliated shops, including sectors such as electronics, clothing, cosmetics, and fuel stations. To identify points of sale that accept vouchers, you can use the "Satispay Benefits" (Buoni Acquisto) filter in the "Shops" section of the Satispay app.

Yes, Satispay Benefits are valid for one year from issuance.

Satispay Benefits can be used both in affiliated physical stores and for the purchase of digital gift cards directly through the app.

No, the value of Satispay Benefits cannot be converted into cash nor transferred to third parties.

Corporate welfare includes a set of goods and services that companies make available to employees to improve their well-being and quality of life. Thanks to these tools, companies can offer personalized benefits that not only incentivize productivity but also allow for cost optimization through specific tax breaks. Corporate welfare plans can include various types of services, including reimbursement for education expenses, healthcare, sports subscriptions, and public transport. The goal is to support the worker in fundamental aspects of daily life, guaranteeing greater balance between the personal and professional spheres.

Corporate welfare includes a set of goods and services that companies make available to employees to improve their well-being and quality of life. Thanks to these tools, companies can offer personalized benefits that not only incentivize productivity but also allow for cost optimization through specific tax breaks. Corporate welfare plans can include various types of services, including reimbursement for education expenses, healthcare, sports subscriptions, and public transport. The goal is to support the worker in fundamental aspects of daily life, guaranteeing greater balance between the personal and professional spheres.

Companies can structure their welfare plan flexibly, choosing from a wide range of solutions to meet employee needs. Benefits provided in the form of services and reimbursements do not contribute to the formation of employee income, allowing significant tax savings. This mechanism makes corporate welfare a strategic lever both for improving worker well-being and for optimizing corporate resources. The deductibility of costs and tax exemptions provided by regulations make welfare an advantageous alternative compared to other forms of economic incentives.

Integrating a corporate welfare plan brings numerous advantages also from a managerial and organizational point of view. A work environment that values employee well-being contributes to increasing productivity, reducing turnover, and attracting talent. The improvement of the corporate climate and job satisfaction is positively reflected in staff engagement and retention, creating a virtuous circle that favors company growth. Adopting custom welfare solutions also allows for responding effectively to new labor market needs, offering added value to both employees and the entire organization.

Do you need help?

We are at your disposal for any additional information. Contact us.

Are you a business?

Should you have any questions regarding our service for accepting payments please email us at business@satispay.com

Mobile lost or stolen?

-> Click here!

We are at your disposal for any additional information. Contact us.

Should you have any questions regarding our service for accepting payments please email us at business@satispay.com

-> Click here!

Payment services are provided by Satispay Europe S.A., registered under no. W00000010 in the Register of Electronic Money Institutions at the Commission de Surveillance du Secteur Financier and under no. B229149 in the Luxembourg Business Register. Registered office: 53, Boulevard Royal, L-2449 Luxembourg.

Corporate welfare services are provided by SatisWelfare S.p.A., tax code and registration number in the Milan Business Register no. 12408640964. Registered office: Piazza Fidia 1, 20159 Milan.

Investment services are provided by Satispay Invest S.A. registered under No. P00000555 in the Register of Investment Firms at the Commission de Surveillance du Secteur Financier and under no. B285448 in the Luxembourg Business Register. Registered office: 53, Boulevard Royal, L-2449 Luxembourg.